BACS Direct Debits & Direct Credits for Salesforce

This guide provides a high-level overview of the functionality you can expect from our SmarterPay BACS install for Salesforce.

The SmarterPay Cloud for Salesforce Managed Package provides all the out of the box tools you need to fulfil your Bacs Direct Debit and Credit requirements. SmarterPay has been carefully built from the ground up to seamlessly fit your business processes and is backed by the SmarterPay Cloud platform.

The SmarterPay Cloud Bacs processing platform is hosted securely in the cloud and acts as a bridge between Salesforce and Bacs, ensuring customer payments are managed correctly and updated accordingly in Salesforce.

All of this is fully supported by our experienced in-house development and client services team who will help you every step of the way.

The SmarterPay Bacs process is completely automated so you do not have to handle file generation and submissions manually, nor do you have to process Bacs reports manually. Security is of the utmost importance to us, so sensitive Bank Account details are not stored in Salesforce which assists in your security and compliance.

Architecture

Standard Direct Debit and Direct Credit Process

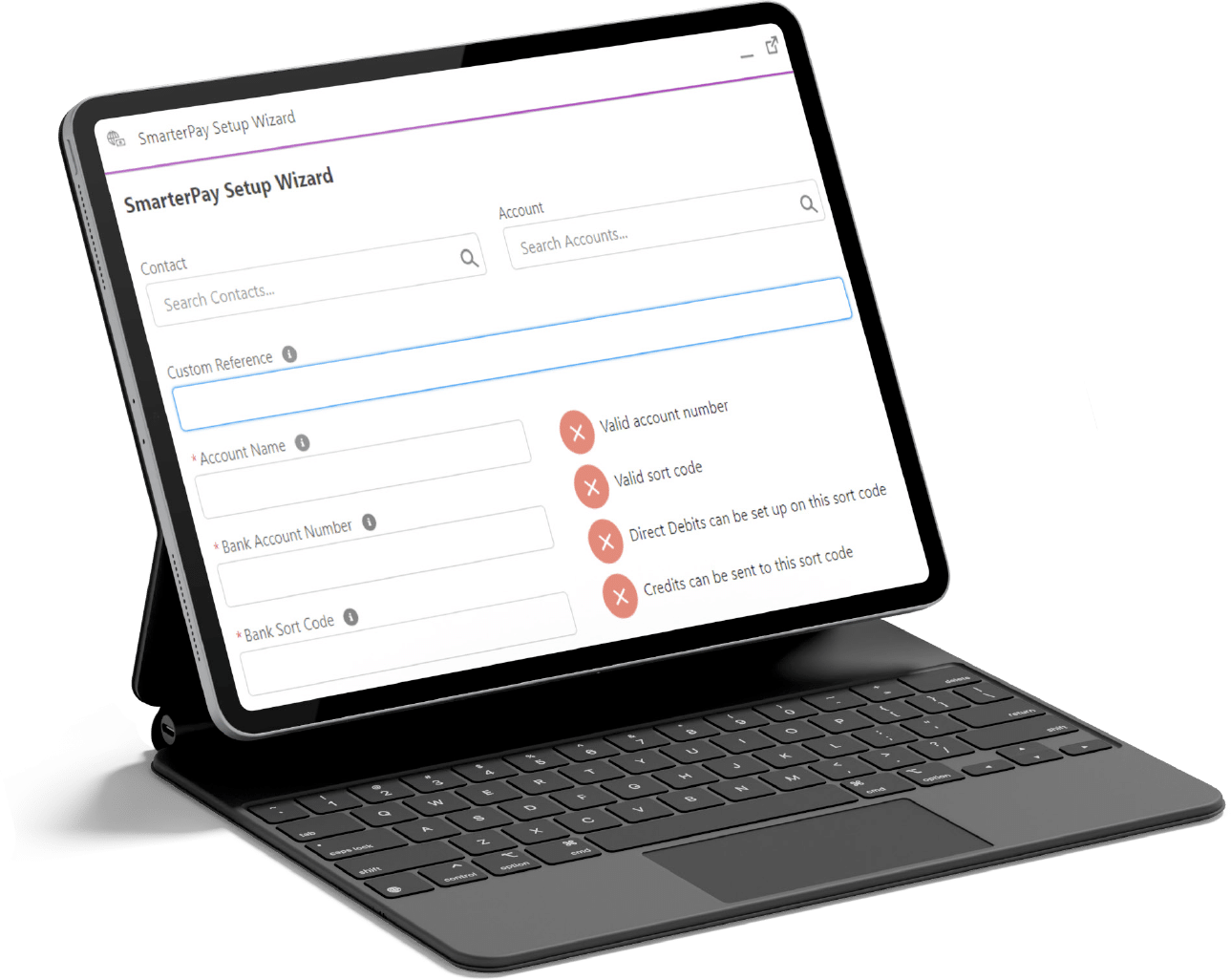

Mandate Setup – Salesforce

Within minutes of installation, a Bank Account and Mandate can be setup for your customer. Simply click on the SmarterPay App and select the Setup Wizard.

We will always Modulus Check bank details against the ‘Extended Industry Sort Code Directory’, to ensure validity of the information input by you or your customer.

This standard flow can be extended to meet any business processes required when creating a Mandate. More complex requirements can be fulfilled by using SmarterPay’s included Apex classes and API. For example, as part of an onboarding process where Contact details are registered, an Opportunity created and finally a Mandate and Recurrence Schedule setup.

Mandate Setup –

Ecommerce/Payment Link

SmarterPay also offer online setup integration that can be completed by your customers. We offer a range of services for online setup. With all options, our dedicated development and client services team will help you every step of the way.

SmarterPay Payment Link (out of the box)

SmarterPay offers customisable out of the box online payment solutions. Links are generated and managed completely in Salesforce, or as part of an external API request for full flexibility. Your customers can be sent the link via email within Salesforce, via SmarterPay Cloud’s email service or even integrated as part of a checkout process.

Bespoke Web Pages

If SmarterPay’s out of the box solution doesn’t quite fit your business, our dedicated and experienced development team can build bespoke webpages for you to match your branding and online payment processes.

SmarterPay API Integration

If you have your own development resource, we provide a series of easy to consume API endpoints to generate Mandates. This empowers you to integrate SmarterPay quickly and seamlessly into existing online payment websites and processes.

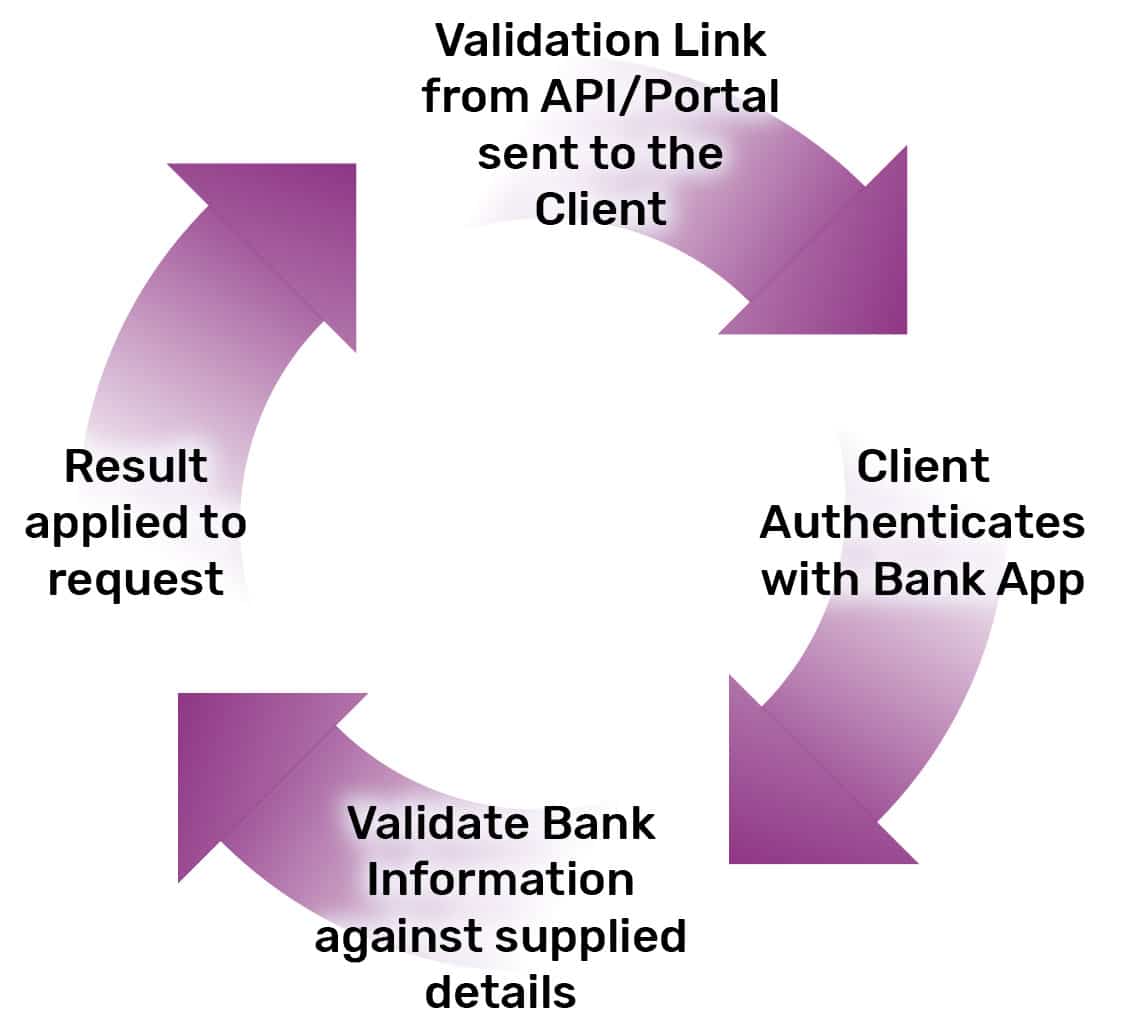

Account Information Services – Know Your Customer

When setting up a Mandate you can request that your customer goes through the AIS process.

Our API connection extends the online direct debit sign up and mandate creation process to validate bank account ownership.

This means that the person signing up for the Direct Debit must have access to the account they want to use. It also checks the bank account name against the one being used for the Direct Debit mandate. Combined with our standard Modulus Checking, this provides an excellent tool to combat fraudulent Direct Debit signups thereby reducing your exposure to potential Direct Debit Indemnity claims.

Debits

The SmarterPay Direct Debit Service works on the Bacs 3 Day Processing Cycle.

This means that a file will be generated and submitted based on relevant direct debit information in Salesforce 2 banking days before the collection day. Bacs Rejections (ARUDDS) are processed by the system automatically and Salesforce is informed of any payment failures.

SmarterPay provides a series of out-of-the-box solutions for recurring collections depending on your requirements:

Single Collection

Ad-hoc repeat debit collections can be made manually in Salesforce in a few clicks of the mouse using SmarterPay’s out of the box component or automatically using our easy-to-use API.

Managed Recurring Collections

Simply set up a schedule against a Mandate and SmarterPay will manage the rest. SmarterPay offers two types of managed recurring schedules:

Ongoing Payment: A regular amount taken at set intervals; with or without an end-date.

This is typically used for memberships or subscriptions.

Payment Plan: A set amount paid over weeks, months, or years. These are used to pay for specific services or products; for example, monthly payments to pay off a large purchase.

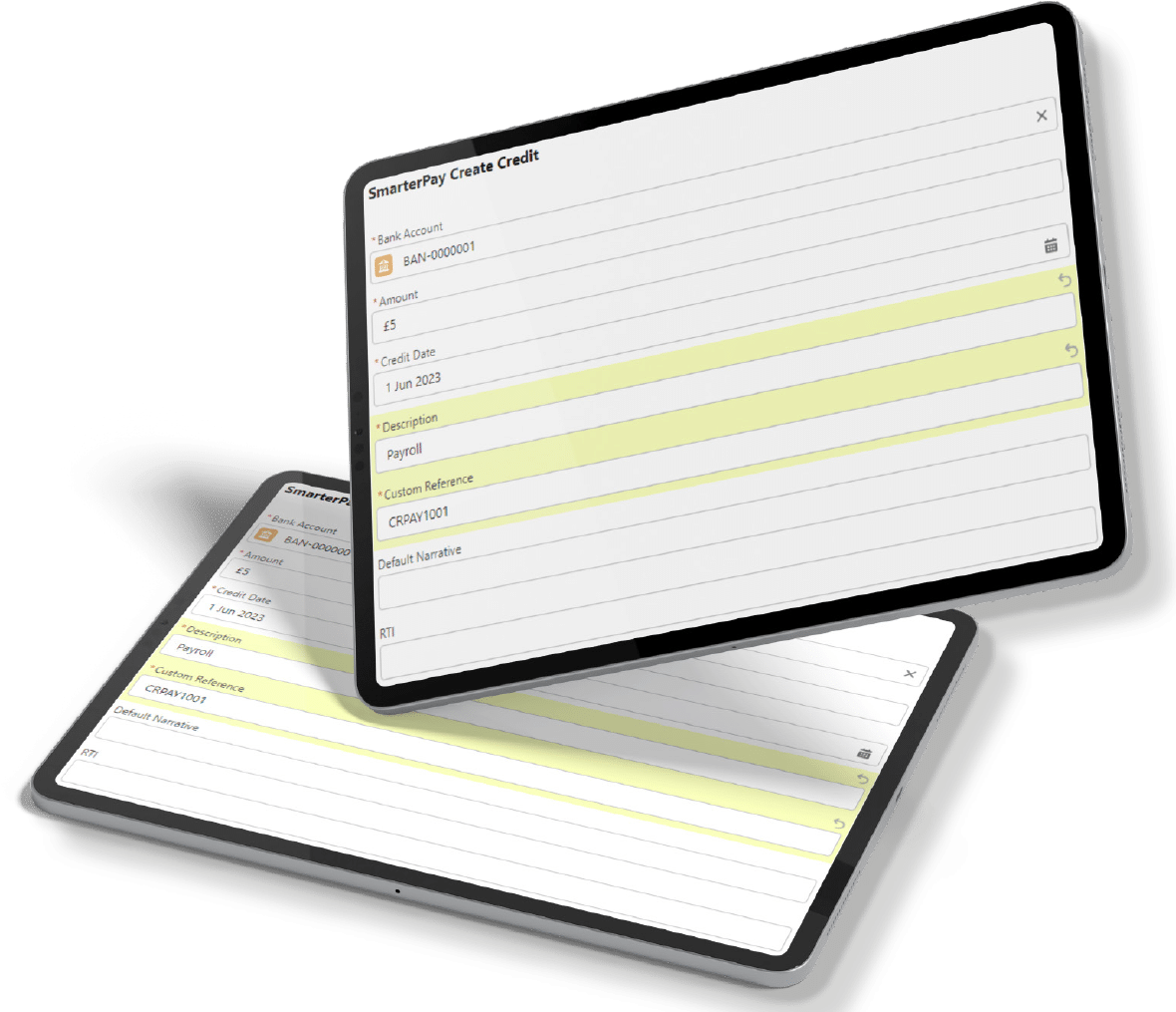

Credits

The SmarterPay Direct Credit Service works on the Bacs 3 Day Processing Cycle.

This means that a file will be generated based on relevant direct credit information in Salesforce 2 banking days before the collection day. Bacs Rejections (ARUCS) are processed by the system automatically and Salesforce is informed of any credit failures.

SmarterPay provides an in-built easy way to generate credits with a few simple clicks of the mouse. Alternatively, credits can be generated as part of a more complex process, such as a monthly payroll run.

Our technical support team will guide you every step of the way.

SmarterPay Limited

Utility House

32-36 Prospect Street

Kingston Upon Hull

East Riding of Yorkshire

HU2 8PX