How to Switch Bacs Software Solutions

Switching your Bacs software solutions is a big decision. But it doesn’t have to be complicated.

With the right plan, you can protect your Service User Number (SUN), keep payments running smoothly, improve efficiency and save costs at the same time. This guide explains, step by step, how to move from your existing Bacs provider to SmarterPay Cloud.

Why organisations choose SmarterPay

Companies switch to us for several reasons, often linked to ease of use, automation, and support. Some of the most common drivers are:

No installations or smartcards

Everything runs securely in your web browser. No local software to manage, no tokens to lose, and no waiting for IT to install updates.

Built for automation

SmarterPay offers APIs, SFTP, dashboards, and webhooks to integrate with your existing finance and CRM systems.

Compliance and security

ISO 27001 and PCI DSS certification give reassurance that sensitive payment data is handled securely.

Flexible pricing

Monthly billing and workflow-based options mean you pay for what you use.

UK-based support

A knowledgeable team with defined SLAs is on hand when you need them. For example, a mid-sized charity recently moved from a legacy on-premise system to SmarterPay. Their main reason was removing the hassle of smartcards and giving volunteers secure, browser-based access instead. The migration reduced admin effort and improved reporting.

What you’ll need before you start. Before beginning the migration, gather the following:

Your Service User Number (SUN)

This is your 6-digit unique ID on the Bacs network.

Contact your sponsoring bank

They’ll be the ones to update your SUN details.

A clear view of your current process

How you submit files, which reports you need, and who is involved.

A project lead

Ideally, someone from finance or operations who can coordinate with SmarterPay and your bank. No installations or smartcards

The Migration Process

Step 1

Kick-off and planning

Every successful migration starts with planning. At this stage, we will hold a scoping workshop with you to:

![]() Review how you currently submit payment files.

Review how you currently submit payment files.

![]() Confirm how you collect Direct Debits and which reports (AUDDIS, ARUDD, ADDACS, DDICA) you rely on.

Confirm how you collect Direct Debits and which reports (AUDDIS, ARUDD, ADDACS, DDICA) you rely on.

![]() Understand your cut-off times and payment cycles.

Understand your cut-off times and payment cycles.

![]() Identify opportunities for automation, such as reconciliation or notifications.

Identify opportunities for automation, such as reconciliation or notifications.

Based on this, a transition plan is agreed. This includes key milestones, responsibilities, and a fallback option in case you need to revert during your first live cycle.

Some organisations choose to plan their go-live date outside of their busiest periods. For example, a university might avoid peak fee collection times so they can test smaller payment runs first and reduce the risk of disruption.

Step 2

SUN setup with your sponsoring bank

Your SUN is essential. Without it being registered to SmarterPay, you won’t be able to process payments.

![]() 2. Ask them to link your Service User Numbers (SUN) to the new Bacs approved Bureau.

2. Ask them to link your Service User Numbers (SUN) to the new Bacs approved Bureau.

![]() 3. Confirm your SUN permissions cover the transaction types you need (Direct Debits, Direct Credits, or both).

3. Confirm your SUN permissions cover the transaction types you need (Direct Debits, Direct Credits, or both).

![]() 4. Repeat this step if you operate with multiple SUNs.

4. Repeat this step if you operate with multiple SUNs.

Step 3

Onboarding and configuration

With your SUN ready, SmarterPay creates your secure account and helps you configure your setup. This includes:

![]() User access. Logins with optional multi-factor authentication (MFA) and IP restrictions.

User access. Logins with optional multi-factor authentication (MFA) and IP restrictions.

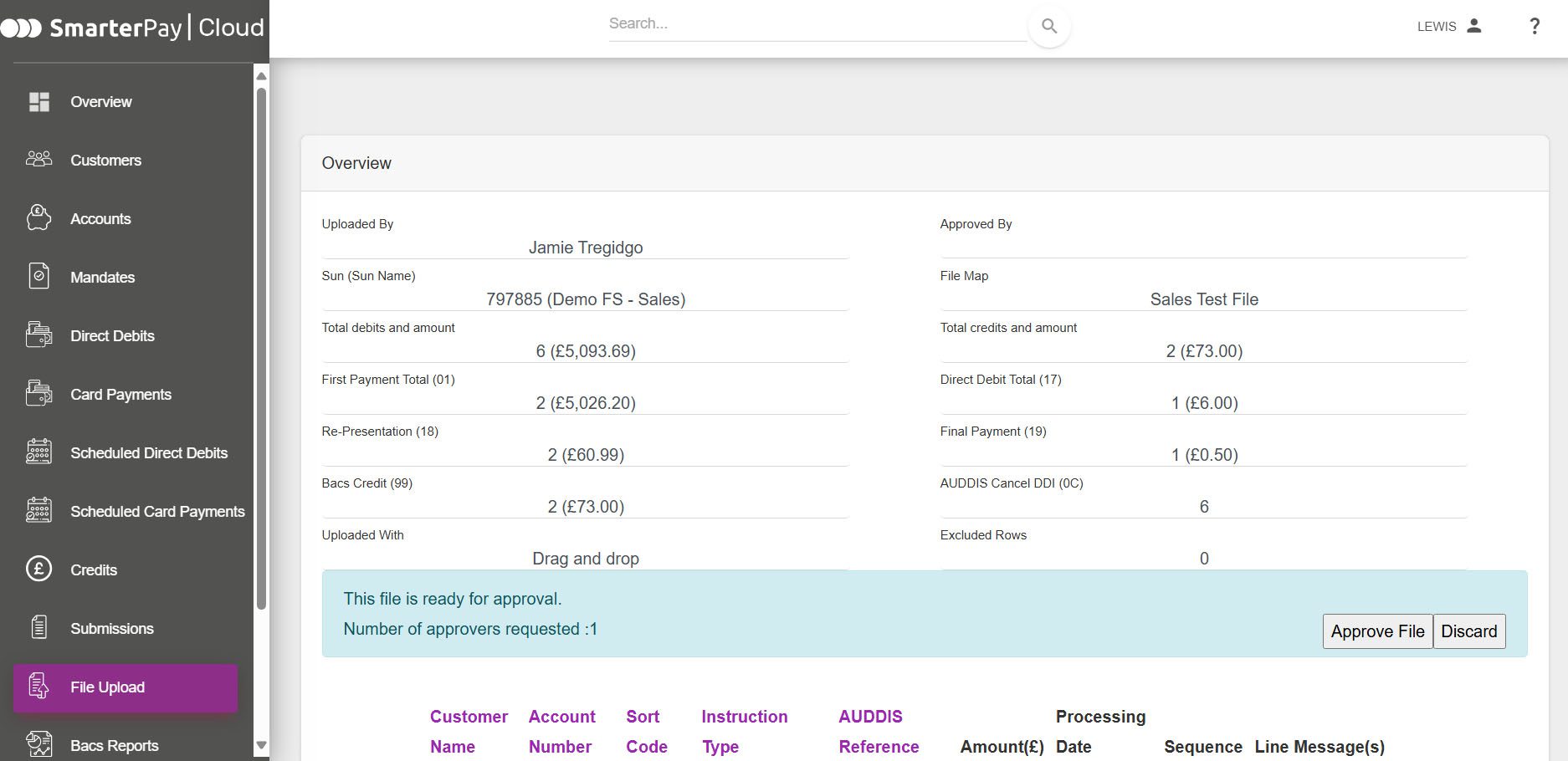

![]() Workflow setup. Define how files move through the system, approvals required, and notification rules.

Workflow setup. Define how files move through the system, approvals required, and notification rules.

![]() Connectivity. Configure SFTP or API integrations for automated file submissions.

Connectivity. Configure SFTP or API integrations for automated file submissions.

![]() Reporting and dashboards. Set up monitoring to track every transaction.

Reporting and dashboards. Set up monitoring to track every transaction.

Training is included, with online sessions, user guides, and recorded materials so your team can learn at their own pace.

Many organisations use onboarding as a chance to strengthen internal controls. For example, a housing association could configure approval workflows in SmarterPay so that large payment runs require two sign-offs, mirroring their existing policies.”

Step 4

Testing and validation

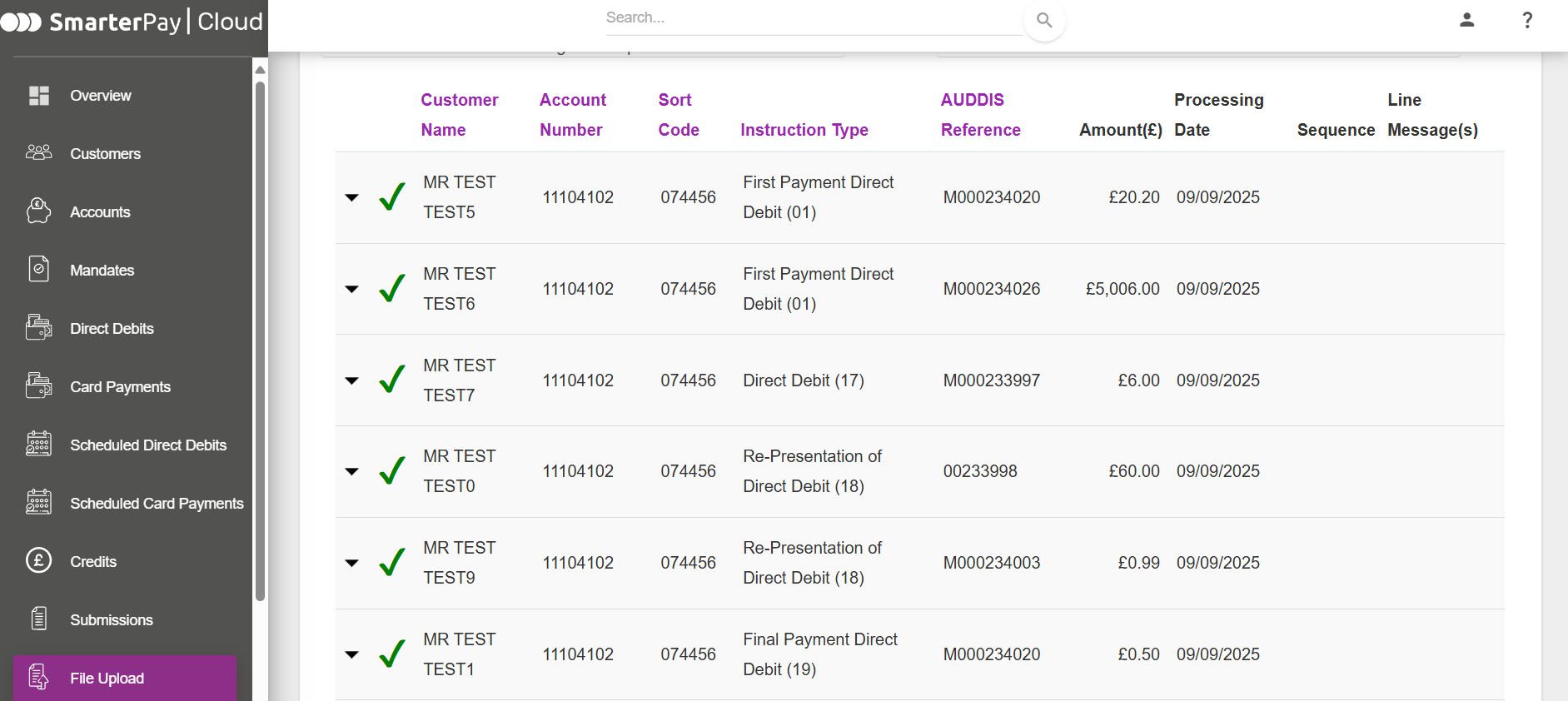

Before you go live, thorough testing ensures accuracy. In SmarterPay’s UAT environment, you can:

![]() Submit trial payment files using your SUN.

Submit trial payment files using your SUN.

![]() Check validation results, such as account number modulus checks.

Check validation results, such as account number modulus checks.

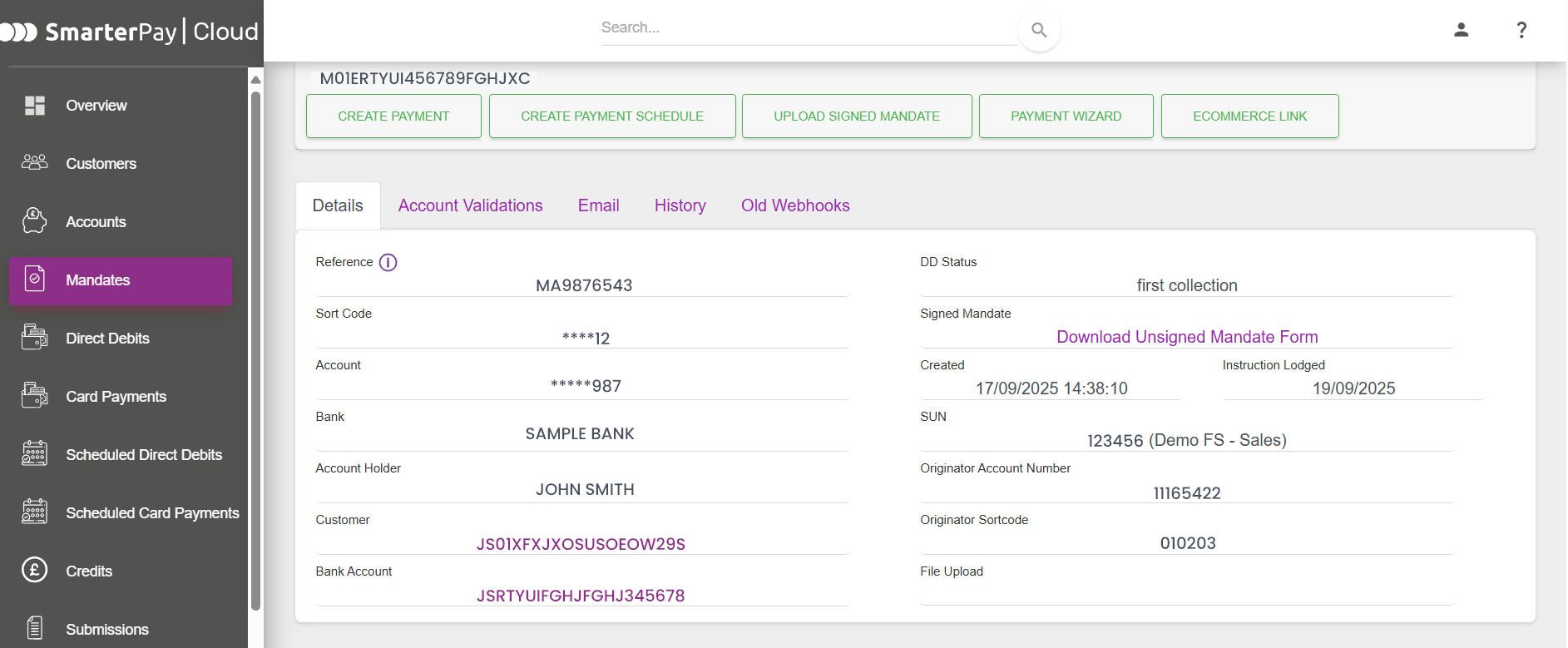

![]() Test mandate migration if you’re moving Direct Debit mandates.

Test mandate migration if you’re moving Direct Debit mandates.

![]() Review exception handling, such as rejected payments.

Review exception handling, such as rejected payments.

Finance teams should compare test outputs with bank reports to ensure everything reconciles. Sign-off at this stage gives confidence that the system is ready.

Tip: Test both routine cases (such as a standard Direct Debit run) and exceptions (such as an unpaid item). This ensures staff are prepared for all outcomes.

Tip: Always ask for written confirmation from your bank once the SUN is linked to SmarterPay. This will avoid delays at go-live.

Direct Debit Management Software

Step 5

Go live with SmarterPay Cloud

Once testing is approved, you can go live.

![]() Switch to production. Submit your first live file through SmarterPay.

Switch to production. Submit your first live file through SmarterPay.

![]() Monitor closely. Use dashboards and audit logs to watch transactions in real time.

Monitor closely. Use dashboards and audit logs to watch transactions in real time.

![]() Start small. Many organisations choose a less critical payment cycle for their first run before moving high-volume cycles.

Start small. Many organisations choose a less critical payment cycle for their first run before moving high-volume cycles.

Example: It’s common to start go-live with a smaller payment run, such as a payroll batch, before moving larger cycles like supplier payments. This allows the team to confirm reconciliation works smoothly before scaling up.

File breakdown during approval

Step 6

Decommission your old provider

With SmarterPay live, it’s time to close down your old system:

![]() Complete any final runs still pending in the old software.

Complete any final runs still pending in the old software.

![]() Export historic data you need for audit or analysis.

Export historic data you need for audit or analysis.

![]() Confirm with your bank that your old provider is no longer linked to your SUN..

Confirm with your bank that your old provider is no longer linked to your SUN..

This ensures a clean cutover and avoids confusion with duplicate submissions. .

Modulus checking

Step 7

Ongoing operation and support

Once live, SmarterPay becomes your day-to-day Bacs platform. Support is available in two levels:

![]() Standard: phone and email support with a 4-hour critical response time.

Standard: phone and email support with a 4-hour critical response time.

![]() Premium: a 1-hour response and remote support included.

Premium: a 1-hour response and remote support included.

Best practices for ongoing use include:

![]() Regularly reviewing and updating user access.

Regularly reviewing and updating user access.

![]() Scheduling periodic reviews with SmarterPay to ensure your setup continues to meet your needs.

Scheduling periodic reviews with SmarterPay to ensure your setup continues to meet your needs.

![]() Keeping process documentation updated for audit purposes.

Keeping process documentation updated for audit purposes.

The Migration Timeline

Every organisation’s journey is different, and the time it takes to move to SmarterPay will vary. A key factor is how quickly your sponsoring bank completes the SUN registration process.

For some, this can be straightforward, while for others it may take longer depending on the bank’s response times. The number of SUNs you need to set up can also influence the pace, as each one requires its own registration and checks.

Another consideration is the level of configuration you want. If you are setting up straightforward file submissions, the process can be faster. If you intend to configure APIs, build automated workflows, or set up complex approval chains, the setup stage will naturally take more time. Finally, the availability of your internal team plays a role. Testing, training, and sign-off all need input from finance and IT, and projects tend to move more quickly when those resources are fully engaged.

Because of these variables, some organisations complete their migration within a matter of weeks, while others take longer if their requirements are more complex. The important thing is to focus less on the exact timeline and more on moving through each stage in the right order: planning, SUN registration, onboarding, testing, go-live, and finally, decommissioning the old provider.

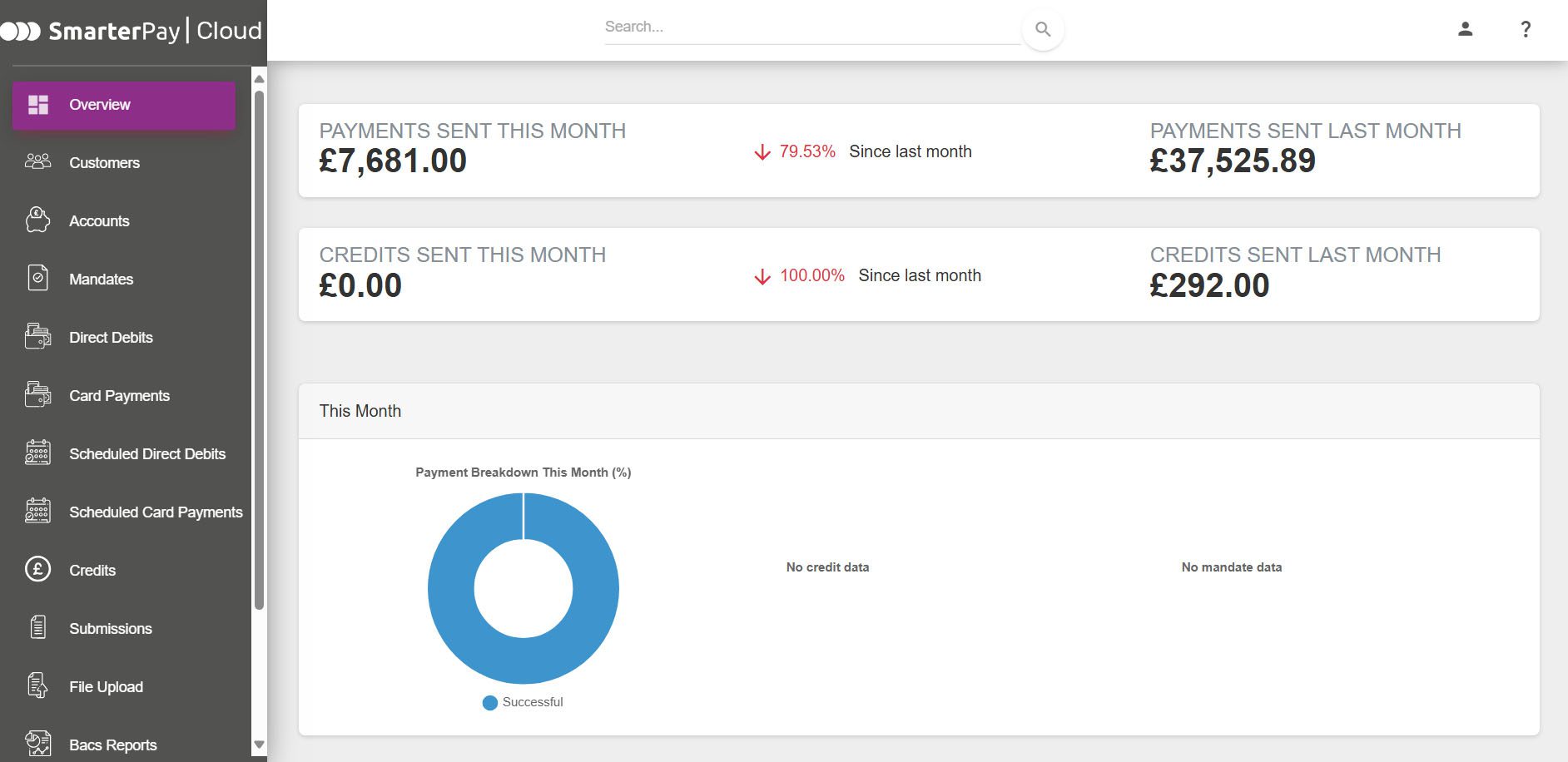

SmarterPay Dashboard

Frequently Asked Questions

Q. Do we need to install software or use smartcards?

A. No. SmarterPay is browser-based, so you log in securely from anywhere.

Q. Will our SUN change?

A. No. Your SUN remains the same, you’re simply registering it with SmarterPay.

Q. Can we keep our current file formats?

A. Yes. SmarterPay can map your existing file formats and validate them automatically.

Q. What if we have multiple SUNs?

A. Each SUN must be registered separately with your bank, but SmarterPay can handle multiple SUNs under one account.

Q. What support is available after migration?

A. Standard and Premium support options are available, with defined SLAs for response times.

Final Thoughts

Switching Bacs providers is a chance to simplify your payment process, future-proof your setup and save costs. With a structured plan, clear milestones, and support from our team, the move can be smooth and low-risk.

The key is to:

2. Test thoroughly in UAT before going live.

3. Decommission your old provider carefully to avoid duplication

Our onboarding team can help to guide you through each stage. Contact us today by calling +44 1482 240886 or email us at sales@smarterpay.com

LET’S TALK…

SmarterPay Limited

Utility House

32-36 Prospect Street

Kingston Upon Hull

East Riding of Yorkshire

HU2 8PX